- Contact Us

- 480-922-5552

- info@aheadofthecurvelaw.com

Aretha Franklin’s Multi-million Dollar Estate?

Why You Should Hire An Estate Planning Attorney

May 17, 2018

October is National Special Needs Law Month

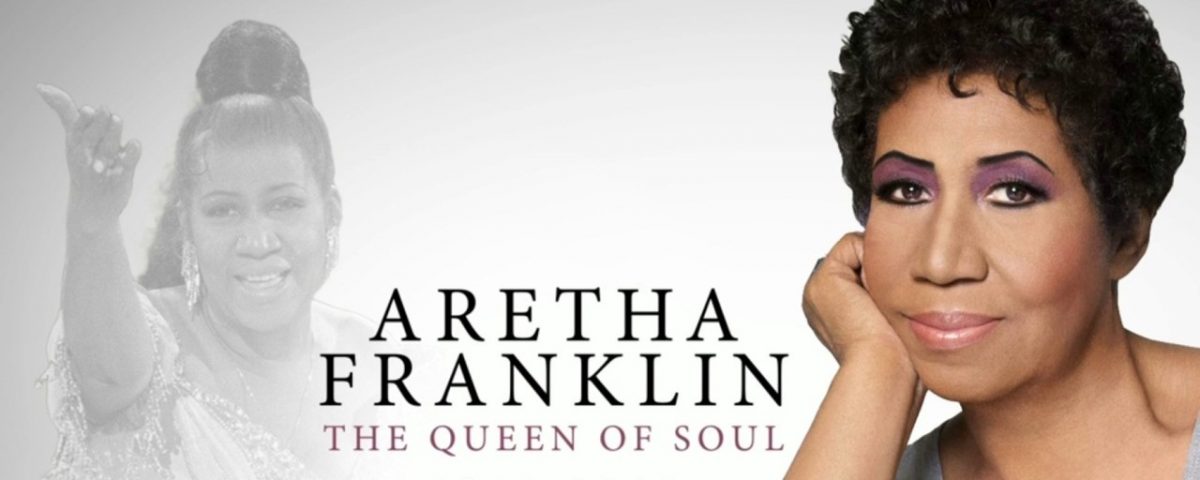

October 19, 2018Without A Will, What Will Happen to Aretha Franklin’s Multi-million Dollar Estate?

Music legend and civil rights activist, Aretha Franklin, may have left behind a legacy when she died, but she also left us with a valuable lesson. The 76-year-old Queen of Soul reportedly had no will or estate plan, which could result in the government taking away nearly half of her $80 million estate. It also exposes Franklin’s heirs to estate taxes and potential family conflicts.

Having no will, estate plan or trust in place means that the State of Michigan, where Franklin resided, is going to write her will for her – including the valuation of her assets and her iconic music catalog – choosing who will be in charge of her estate and dictating where her assets will go. It is a scenario that will likely be played out in the public eye and possibly drag on for several months – possibly even several years.

The lesson? It is a scenario that is also completely and totally avoidable. Having an estate plan would have expedited things, kept them out of probate, and kept them private. It is a simple enough lesson, yet, nearly 60 percent of U.S. adults don’t have a will, according to aarp.com. If you pass away without one — called “dying intestate” — the legal system in your state will decide who gets your assets, no matter how massive or meager. Worse yet, if there are minor children who are left parentless, it will be up to a judge to appoint a guardian to care for them.

Having an estate plan in place for your assets – financial accounts, real estate and personal possessions – prior to your death or disability is partly about making things easier for your loved ones during an already-difficult time, and partly about helping to ensure that upon your death, your wishes are carried out the way you want them to be. Your estate plan should include an organized list of information needed to settle your estate (including logins and passwords for your online accounts) and name specific people to key roles, including an executor of your will, and powers of attorney for both health care and your financial affairs if you become incapacitated.